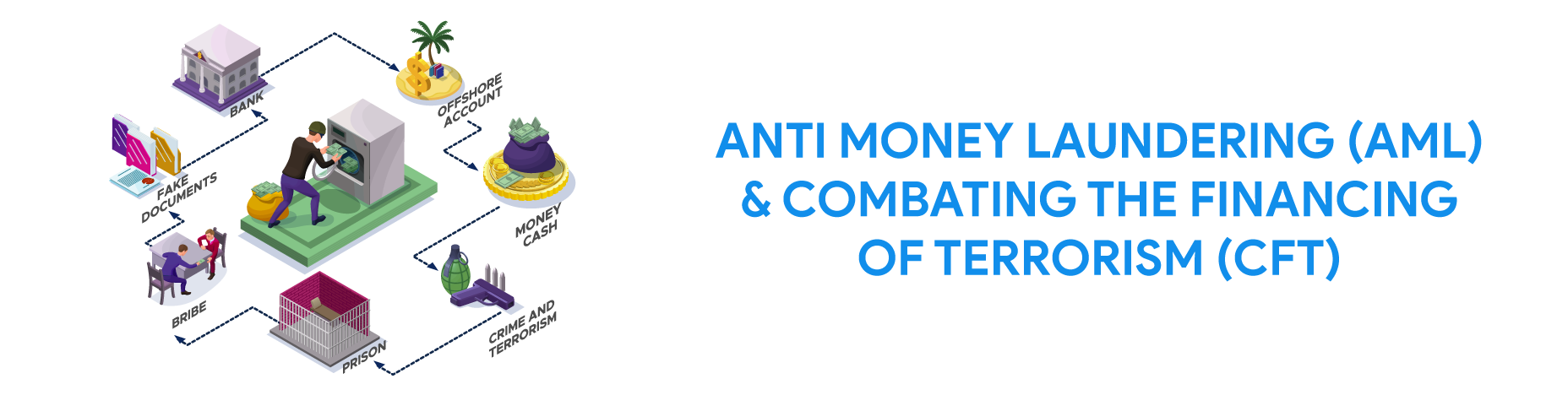

Counter the Financing of Terrorism (AML / CFT)

Digitalexchange.id's Anti-Money Laundering Policy (AML) is designed to prevent money laundering, including the need to have adequate systems and controls to reduce company risks used to facilitate financial crime. This Anti-Money Laundering (AML) Policy sets minimum standards that must be met and includes:

Appointment of Money Laundering (MLRO) Money Laundering Officers who have sufficient levels of seniority and independence and who have the responsibility to oversee compliance with relevant industry laws, regulations, rules and guidelines;

- Establish and maintain a Risk Based Approach (RBA) to assess and manage money laundering and the risk of terrorist funding to companies;

- Establish and maintain risk-based due diligence, identification, verification and customer know-how (KYC) procedures, including better due diligence for customers who have a higher risk, such as Politically Exposed Persons (PEPs);

- Establish and maintain risk-based systems and procedures to monitor ongoing customer activity;

- Procedures for reporting suspicious activities internally and to law enforcement authorities that are relevant as appropriate;

- Maintenance of records that are appropriate for the minimum specified period;

- Training and awareness for all relevant employees

Counter Financing of Terrorism (CFT)

Companies take a risk-based approach when adopting and implementing counter-terrorism (CFT) financing measures and in conducting Anti-Money Laundering (AML) risk assessments.

The company adopts CFT internal controls and makes unspecified decisions regarding CFT matters to replace business, strategic or other operations.

International Sanction Policy (ISP)

Our company is prohibited from transacting with individuals, companies and countries listed in the sanctions list.

Procedure for Knowing Your Customer (KYC)

Individuals can be identified with a National Identity Card (KTP) or Passport stating their current residence address. Digitalexchange.id identifies customers with self-photos, verifies ID cards / passports then stores customer data safely in accordance with privacy policies.